How To Categorize Cleaning Expenses In Quickbooks . Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. In this comprehensive guide, we will delve into the essential techniques for categorizing various aspects within quickbooks, including:. Is dry cleaning a tax deductible for reselling clothing? Learn why proper expense classification is more than just a mundane task—it's a strategic move to avoid audit. 100k+ visitors in the past month Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. 5 star reviews99% retention rate This is something else to consider about employee uniforms, as this expense is not always an expense. 5 star reviews99% retention rate You can find the list of expense categories in this article: How to categorize expenses related to cleaning of products for sale? 100k+ visitors in the past month

from www.youtube.com

This is something else to consider about employee uniforms, as this expense is not always an expense. Is dry cleaning a tax deductible for reselling clothing? Learn why proper expense classification is more than just a mundane task—it's a strategic move to avoid audit. Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. 5 star reviews99% retention rate 5 star reviews99% retention rate How to categorize expenses related to cleaning of products for sale? Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. In this comprehensive guide, we will delve into the essential techniques for categorizing various aspects within quickbooks, including:. You can find the list of expense categories in this article:

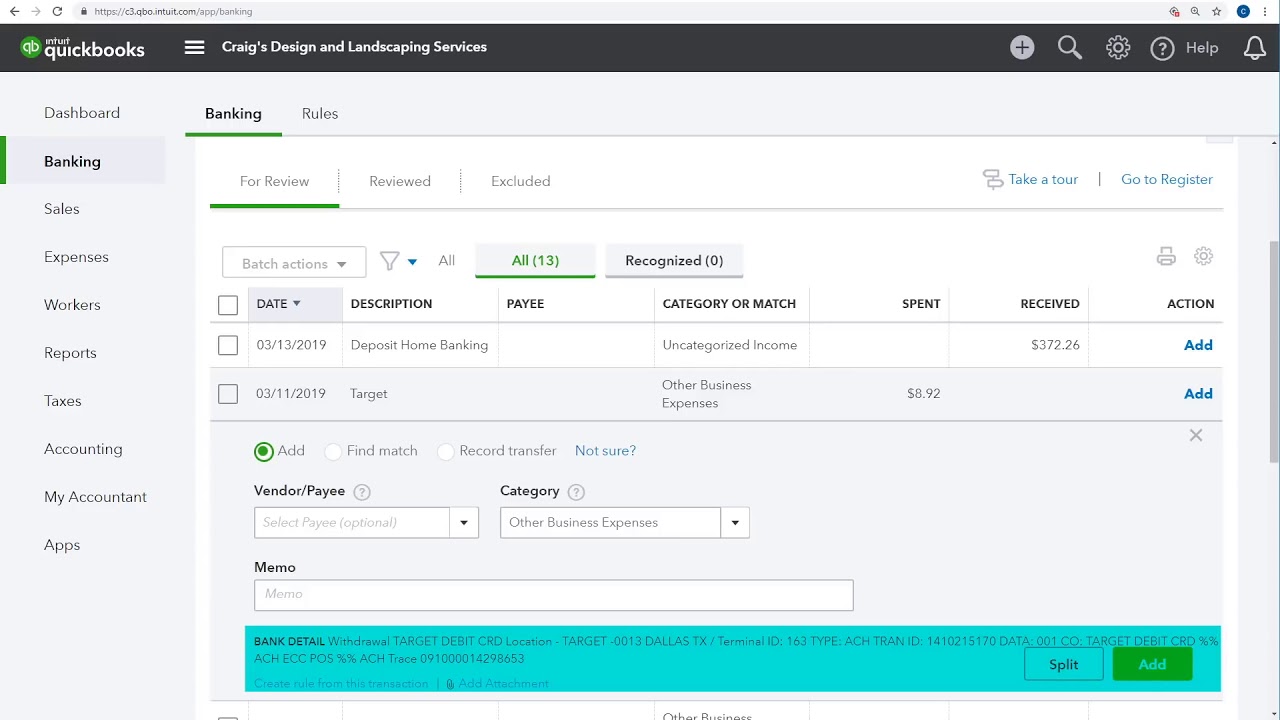

How to Categorize Transactions From Your Bank & Credit Card QuickBooks

How To Categorize Cleaning Expenses In Quickbooks 100k+ visitors in the past month How to categorize expenses related to cleaning of products for sale? Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. 5 star reviews99% retention rate This is something else to consider about employee uniforms, as this expense is not always an expense. 100k+ visitors in the past month Learn why proper expense classification is more than just a mundane task—it's a strategic move to avoid audit. Is dry cleaning a tax deductible for reselling clothing? 100k+ visitors in the past month In this comprehensive guide, we will delve into the essential techniques for categorizing various aspects within quickbooks, including:. 5 star reviews99% retention rate Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. You can find the list of expense categories in this article:

From onlinebusiness.umd.edu

How to Categorize Expenses and Assets in Business UMD Online How To Categorize Cleaning Expenses In Quickbooks Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. Learn why proper expense classification is more than just a mundane task—it's a strategic move to avoid audit. 100k+ visitors in the past month You can find the list of expense categories in this article: This is something else. How To Categorize Cleaning Expenses In Quickbooks.

From scribehow.com

How to categorize in QuickBooks Online Scribe How To Categorize Cleaning Expenses In Quickbooks Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. In this comprehensive guide, we will delve into the essential techniques for categorizing various aspects within quickbooks, including:. 100k+ visitors in the past month 5 star reviews99% retention rate How to categorize expenses related to cleaning of products for sale? Learn why. How To Categorize Cleaning Expenses In Quickbooks.

From www.pinterest.com

How to clean up Undeposited Funds in QuickBooks Online. Step by step How To Categorize Cleaning Expenses In Quickbooks How to categorize expenses related to cleaning of products for sale? Learn why proper expense classification is more than just a mundane task—it's a strategic move to avoid audit. You can find the list of expense categories in this article: 5 star reviews99% retention rate Expenses should be categorized in a way that reflects the nature of each expense, such. How To Categorize Cleaning Expenses In Quickbooks.

From wellkeptclutter.com

Maid Service Bookkeeping A Beginners Guide. WellKeptClutter How To Categorize Cleaning Expenses In Quickbooks Learn why proper expense classification is more than just a mundane task—it's a strategic move to avoid audit. 5 star reviews99% retention rate This is something else to consider about employee uniforms, as this expense is not always an expense. 100k+ visitors in the past month You can find the list of expense categories in this article: Expenses should be. How To Categorize Cleaning Expenses In Quickbooks.

From www.pinterest.com

QuickBooks Online Categorize and Match Bank Transactions Quickbooks How To Categorize Cleaning Expenses In Quickbooks 100k+ visitors in the past month Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. 5 star reviews99% retention rate 100k+ visitors in the past month Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. 5 star reviews99% retention. How To Categorize Cleaning Expenses In Quickbooks.

From loans-detail.blogspot.com

How To Categorize Car Payment In Quickbooks Info Loans How To Categorize Cleaning Expenses In Quickbooks Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. 100k+ visitors in the past month Learn why proper expense classification is more than just a mundane task—it's a strategic move to avoid audit. 5 star reviews99% retention rate How to categorize expenses related to cleaning of products for sale? In this. How To Categorize Cleaning Expenses In Quickbooks.

From themumpreneurshow.com

How To Categorize Business Expenses In My Home Budget? The Mumpreneur How To Categorize Cleaning Expenses In Quickbooks How to categorize expenses related to cleaning of products for sale? Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. 100k+ visitors in the past month In this comprehensive guide, we will delve into the essential techniques for categorizing various aspects within quickbooks, including:. Is dry cleaning a tax deductible for. How To Categorize Cleaning Expenses In Quickbooks.

From blackrockbusiness.com

QuickBooks Online Categorize and Match Bank Transactions BlackRock How To Categorize Cleaning Expenses In Quickbooks Is dry cleaning a tax deductible for reselling clothing? 5 star reviews99% retention rate This is something else to consider about employee uniforms, as this expense is not always an expense. 100k+ visitors in the past month Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. 100k+ visitors. How To Categorize Cleaning Expenses In Quickbooks.

From www.youtube.com

How to categorize transactions and set rules in QuickBooks Desktop How To Categorize Cleaning Expenses In Quickbooks 5 star reviews99% retention rate 100k+ visitors in the past month 100k+ visitors in the past month This is something else to consider about employee uniforms, as this expense is not always an expense. You can find the list of expense categories in this article: 5 star reviews99% retention rate Expenses should be categorized in a way that reflects the. How To Categorize Cleaning Expenses In Quickbooks.

From www.youtube.com

Categorize Your Blog Expenses in QuickBooks Online (Part 4 Video 2 How To Categorize Cleaning Expenses In Quickbooks Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. 5 star reviews99% retention rate 100k+ visitors in the past month 100k+ visitors in the past month Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. In this comprehensive guide,. How To Categorize Cleaning Expenses In Quickbooks.

From synder.com

How to Categorize Expenses in QuickBooks Automatically How To Categorize Cleaning Expenses In Quickbooks Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. 5 star reviews99% retention rate In this comprehensive guide, we will delve into the essential techniques for categorizing various aspects within quickbooks, including:. 100k+ visitors in the past month 100k+ visitors in the past month You can find the. How To Categorize Cleaning Expenses In Quickbooks.

From newqbo.com

How can I make batch changes to categorized transactions without having How To Categorize Cleaning Expenses In Quickbooks Is dry cleaning a tax deductible for reselling clothing? Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. In this comprehensive guide, we will delve into the essential techniques for categorizing various aspects within quickbooks, including:. 5 star reviews99% retention rate 100k+ visitors in the past month Effectively. How To Categorize Cleaning Expenses In Quickbooks.

From www.youtube.com

How to Categorize Credit Card Payments in QuickBooks? MWJ Consultancy How To Categorize Cleaning Expenses In Quickbooks 5 star reviews99% retention rate Is dry cleaning a tax deductible for reselling clothing? Learn why proper expense classification is more than just a mundane task—it's a strategic move to avoid audit. This is something else to consider about employee uniforms, as this expense is not always an expense. 5 star reviews99% retention rate 100k+ visitors in the past month. How To Categorize Cleaning Expenses In Quickbooks.

From www.youtube.com

How to Categorise Expenses w/ QuickBooks SelfEmployed on The Web YouTube How To Categorize Cleaning Expenses In Quickbooks How to categorize expenses related to cleaning of products for sale? 100k+ visitors in the past month Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. 5 star reviews99% retention. How To Categorize Cleaning Expenses In Quickbooks.

From www.gentlefrog.com

How to Record A Payment To A Loan In QuickBooks Online Gentle Frog How To Categorize Cleaning Expenses In Quickbooks Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. 100k+ visitors in the past month Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. Is dry cleaning a tax deductible for reselling clothing? 100k+ visitors in the past month. How To Categorize Cleaning Expenses In Quickbooks.

From ethanthompson.z19.web.core.windows.net

Chart Of Accounts Example For Construction How To Categorize Cleaning Expenses In Quickbooks How to categorize expenses related to cleaning of products for sale? In this comprehensive guide, we will delve into the essential techniques for categorizing various aspects within quickbooks, including:. 5 star reviews99% retention rate 100k+ visitors in the past month 5 star reviews99% retention rate Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices. How To Categorize Cleaning Expenses In Quickbooks.

From www.youtube.com

How to categorize/record transaction in QuickBooks Online YouTube How To Categorize Cleaning Expenses In Quickbooks Effectively categorizing office cleaning expenses in quickbooks requires adherence to specific tips and best practices for accurate expense. Learn why proper expense classification is more than just a mundane task—it's a strategic move to avoid audit. Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead, and general. 100k+ visitors in. How To Categorize Cleaning Expenses In Quickbooks.

From s3.us-east-1.wasabisys.com

Office Cleaning How To Categorize Cleaning Expenses In Quickbooks How to categorize expenses related to cleaning of products for sale? Is dry cleaning a tax deductible for reselling clothing? You can find the list of expense categories in this article: 5 star reviews99% retention rate 5 star reviews99% retention rate Expenses should be categorized in a way that reflects the nature of each expense, such as materials, labor, overhead,. How To Categorize Cleaning Expenses In Quickbooks.